3888 Stillwell Beckett Rd Oxford, OH 45056

Capital credits: Understanding your options

A message from your co-op manager of accounting and finance, Evan Rauch.

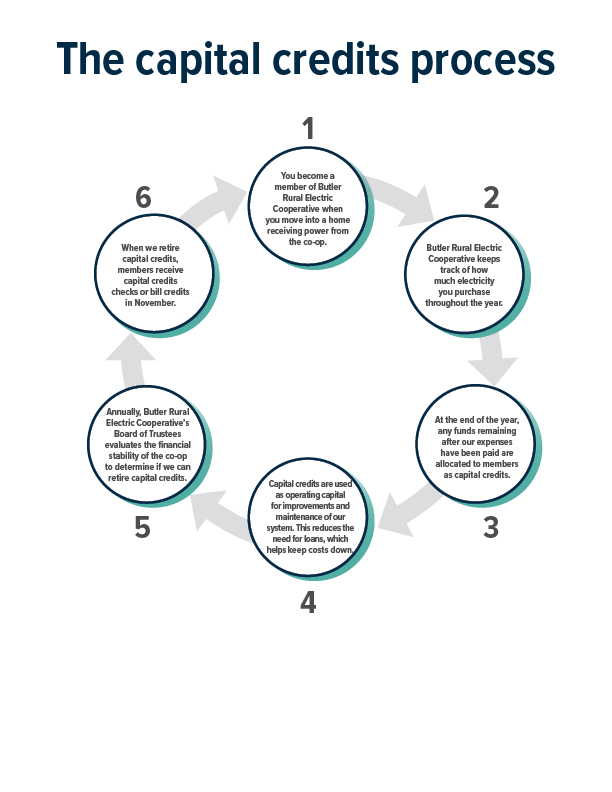

How capital credits work

Our unique business model sets Butler Rural Electric Cooperative apart from other utilities. Capital credits serve as a benefit to members and represent your stake and investment in the cooperative. These credits are important to funding crucial elements such as poles, wires, transformers, and other essential infrastructure, all of which contribute to the long-term strength and reliability of the cooperative.

By leveraging capital credits, we finance capital improvements and projects that are important to sustaining your electric system. Retaining capital credits also reduces the need for loans. This helps lessen the costs associated with electricity, ultimately benefiting all of our members.

Annually, Butler Rural Electric Cooperative’s board of trustees evaluates the cooperative’s financial health to determine the feasibility of retiring capital credits. The board of trustees approves the comprehensive retirement plan, ensuring both current and former members receive their capital credits retirements over time — to put money back in the pockets of you, the owners of our cooperative.

Changes to capital credits retirement beginning in 2027

Butler Rural Electric Cooperative’s board of trustees is modernizing the cooperative’s capital credits process to compassionately handle the accounts of deceased members. This change gives members two options for how capital credits are handled after death. The method you choose affects who receives your capital credits and when they are paid. Understanding and exploring these options is important. Before capital credits can be paid, any outstanding balance on a member’s account must be paid. If the account is not paid in full, the capital credits will be held against the debt. Any outstanding debts will have capital credits applied to them at a net present value. The amount will be calculated to the net present value based on the current number of years in the retirement cycle.

Option 1 – Estate retirement

With this option, capital credits will be paid to the probated estate of the deceased member. In this case, the estate will receive capital credits at a net present value. The amount will be calculated to the net present value based on the current number of years in the retirement cycle.

Option 2 – Transfer on Death (TOD) Beneficiary

To avoid the estate process, you can opt to designate a primary beneficiary to receive your capital credits. Upon death, capital credits will be assigned to the designee’s account and be treated as patronage capital subject to the same general retirement cycle for all cooperative members. This helps ensure your capital credits are handled according to your wishes in the future.

Butler Rural Electric Cooperative will begin accepting TOD forms on January 2, 2026. The form must be signed by the current member and notarized. Fill out and print the TOD form and return it to our office. Forms are also available at the cooperative’s office.

You can change designated beneficiaries by filing a new form and can cancel a TOD form by notifying the cooperative. It is the member’s responsibility to keep the information on the TOD form current. This includes the mailing address for the beneficiary. A power of attorney representative cannot file a TOD form to themselves.

What happens if no one claims your capital credits after you die?

Unclaimed capital credits of deceased members are subject to forfeiture, just as general retirement capital credits are. It’s a good idea to mention to those who will be responsible for your affairs that you are a Butler Rural Electric Cooperative member and there could be capital credits among your assets to be claimed. If you have questions regarding the various methods of handling capital credits at death, please contact us at 513- 867-4400 Monday through Friday, 7:30 a.m. to 4:30 p.m.